Our Services

Due Diligence

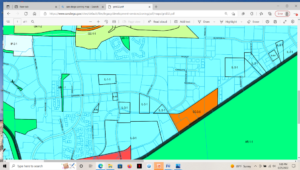

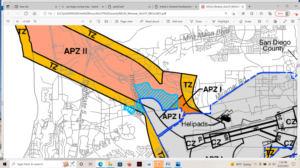

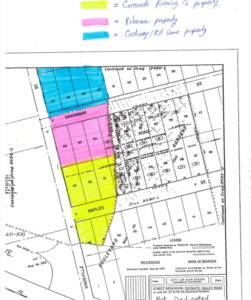

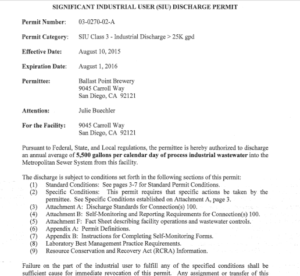

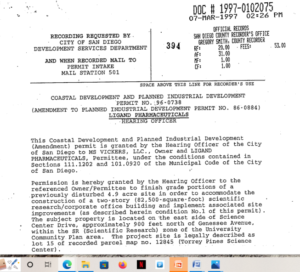

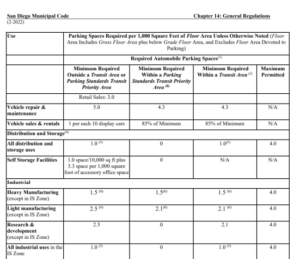

Brokers are there to help you negotiate a good price, get a good lease rate and acceptable terms, but their knowledge of complex land use, permitting and licensing issues will be limited. The real estate development process can be complicated and expensive, and as a buyer, developer, or tenant you will typically be responsible for all improvement costs on and around the property including utility connections and upgrades. We not only check zoning to ensure that your operations, or those of your prospective tenants, will be permitted on the property or properties that you are considering for purchase, development, or lease, but also for overlay zones, existing discretionary permits, General and Community Plan conformance, building code issues, public improvement requirements/costs, utility requirements, and evaluate the impact of easements and covenants recorded in favor of public agencies

Development Strategies and Project Planning

Building upon the completed due diligence, we can help you and your development team to map out a strategy to avoid:

- Costly and lengthy discretionary permit processes

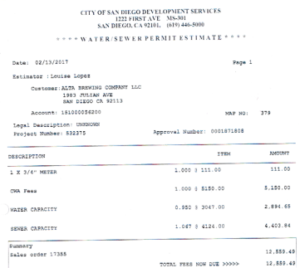

- Excessive impact fees (traffic, housing, public arts, water, sewer, etc.)

- Water and sewer connection/use issues

- Delays in the ministerial (building and grading) permit process

- Municipal government exactions such as right-of-way improvements

Permit Assistance

We have deep knowledge of the permitting and land use approval process in the City of San Diego including personal contacts in all of the relevant departments. We can help your architects and engineers to develop complete construction drawings and modify them as needed to obtain the necessary approvals and permits.

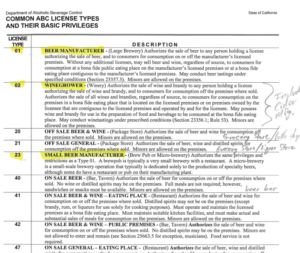

Alcoholic Beverage Licenses

We understand the “non-retail” alcoholic beverage licensing process (License Types 01, 02, 04, 23, and 74) in California for beverage manufacturers. During the real estate due diligence phase and after purchase and lease we can suggest application and negotiation strategies to avoid costly delays due to protests from residents or local police departments.

Economic Development Incentives from Local Governments

We are familiar with the financial incentives offered by the City of San Diego and other California cities. These include tax rebates, loan programs, fee waivers and reimbursements and similar programs designed to attract new investment into various jurisdictions.

Municipal Consulting – Structuring Tax Incentive Programs

Our founder and principal developed California’s first Business Cooperation Program, in and for the City of San Diego, which resulted in net new sales and use tax revenue of over $4 million to San Diego during a 25 year period. We can set up a similar program in your City and train your employees to operate the program which involves strategies to get local businesses to report the entire Bradley-Burns Local 1% sales and use tax to your jurisdiction. We are familiar with all of the following California Department of Tax and Fee (CDTFA) regulations regarding local tax reporting and allocation:

- Regulation 1802

- Regulation 1806

- Regulation 1699.6

Municipal Consulting – Preparing Economic Development Strategies

Our founder and Principal wrote and managed the development of the Economic Development Strategy for the City of San Diego. This strategy not only provides for a thorough background on the strengths and weaknesses of San Diego as a local for new commercial and industrial investment, but also identifies key industry clusters, general policy guidance (“goals and objectives”) but unlike most economic development strategies, provides for 54 distinct action items for implementation. We can prepare the same type of document for your jurisdiction, but also obtain buy-in from key stakeholders in business, academia, and labor and guide presentation of the process and final document for City Council approval.